|

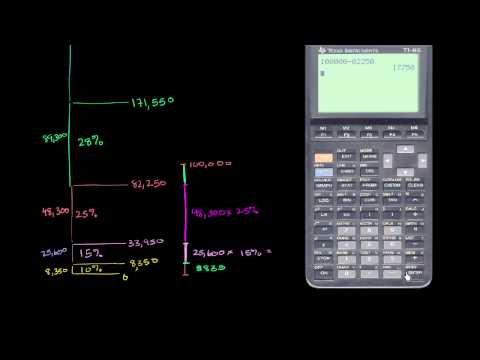

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Categories:

Business

|

|

AlternativesIf you know any alternatives, please let us know. PrerequisitesIf you can suggest any prerequisite, please let us know. Certification Exams-- there are no exams to get certification after this course --If your company does certification for those who completed this course then register your company as certification vendor and add your exams to the Exams Directory. StudentsPeople who learned this course or plan to learn. These people added the course to their Education Passport or their Personal Education Path.  Roman Gelembjuk Test

Roman Gelembjuk Test

S B

S B

Stanislav Naumov

Stanislav Naumov

If you learned this course or plan to learn then add it to your Personal Education Path or your Education Passport | ||

Let us know when you did the course Finance and capital markets: Taxes.

Add the course Finance and capital markets: Taxes to My Personal Education Path.

Select what exam to connect to the course. The course will be displayed on the exam page in the list of courses supported for certification with the exam.

0

0 0

0