Online courses directory (412)

Inflation Overview. What is Inflation. Inflation Data. CPI Index. Moderate Inflation in a Good Economy. Stagflation. Hyperinflation. Real and Nominal Return. Calculating Real Return in Last Year Dollars. Relation Between Nominal and Real Returns and Inflation. Economics of a Cupcake Factory. Cupcake Economics 2. Cupcake Economics 3. Inflation, Deflation & Capacity Utilization. Inflation, Deflation & Capacity Utilization 2. Inflation & Deflation 3: Obama Stimulus Plan. Deflation. Velocity of Money Rather than Quantity Driving Prices. Deflation Despite Increases in Money Supply. Deflationary Spiral. Inflation Overview. What is Inflation. Inflation Data. CPI Index. Moderate Inflation in a Good Economy. Stagflation. Hyperinflation. Real and Nominal Return. Calculating Real Return in Last Year Dollars. Relation Between Nominal and Real Returns and Inflation. Economics of a Cupcake Factory. Cupcake Economics 2. Cupcake Economics 3. Inflation, Deflation & Capacity Utilization. Inflation, Deflation & Capacity Utilization 2. Inflation & Deflation 3: Obama Stimulus Plan. Deflation. Velocity of Money Rather than Quantity Driving Prices. Deflation Despite Increases in Money Supply. Deflationary Spiral.

Introduction to Compound Interest. The Rule of 72 for Compound Interest. Introduction to interest. Interest (part 2). Annual Percentage Rate (APR) and Effective APR. Institutional Roles in Issuing and Processing Credit Cards. Payday Loans. Introduction to compound interest and e. Compound Interest and e (part 2). Compound Interest and e (part 3). Compound Interest and e (part 4). Time Value of Money. Introduction to Present Value. Present Value 2. Present Value 3. Present Value 4 (and discounted cash flow). Personal Bankruptcy: Chapters 7 and 13. Introduction to Compound Interest. The Rule of 72 for Compound Interest. Introduction to interest. Interest (part 2). Annual Percentage Rate (APR) and Effective APR. Institutional Roles in Issuing and Processing Credit Cards. Payday Loans. Introduction to compound interest and e. Compound Interest and e (part 2). Compound Interest and e (part 3). Compound Interest and e (part 4). Time Value of Money. Introduction to Present Value. Present Value 2. Present Value 3. Present Value 4 (and discounted cash flow). Personal Bankruptcy: Chapters 7 and 13.

Introduction to Compound Interest. The Rule of 72 for Compound Interest. Introduction to interest. Interest (part 2). Annual Percentage Rate (APR) and Effective APR. Institutional Roles in Issuing and Processing Credit Cards. Payday Loans. Introduction to compound interest and e. Compound Interest and e (part 2). Compound Interest and e (part 3). Compound Interest and e (part 4). Time Value of Money. Introduction to Present Value. Present Value 2. Present Value 3. Present Value 4 (and discounted cash flow). Personal Bankruptcy: Chapters 7 and 13. Introduction to Compound Interest. The Rule of 72 for Compound Interest. Introduction to interest. Interest (part 2). Annual Percentage Rate (APR) and Effective APR. Institutional Roles in Issuing and Processing Credit Cards. Payday Loans. Introduction to compound interest and e. Compound Interest and e (part 2). Compound Interest and e (part 3). Compound Interest and e (part 4). Time Value of Money. Introduction to Present Value. Present Value 2. Present Value 3. Present Value 4 (and discounted cash flow). Personal Bankruptcy: Chapters 7 and 13.

Open-Ended Mutual Fund (Part 1). Open-End Mutual Fund Redemptions. Closed-End Mutual Funds. Exchange Traded Funds (ETFs). Open-Ended Mutual Funds. Ponzi Schemes. Traditional IRAs. Roth IRAs. 401(k)s. Term and Whole Life. Term and Whole Life Insurance Policies. Term and Whole Life Insurance Policies 2. Term Life Insurance and Death Probability. Hedge Funds Intro. Hedge Fund Structure and Fees. Are Hedge Funds Bad?. Hedge Funds, Venture Capital, and Private Equity. Hedge Fund Strategies - Long Short 1. Hedge Fund Strategies - Long Short 2. Hedge Fund Strategies - Merger Arbitrage 1. Open-Ended Mutual Fund (Part 1). Open-End Mutual Fund Redemptions. Closed-End Mutual Funds. Exchange Traded Funds (ETFs). Open-Ended Mutual Funds. Ponzi Schemes. Traditional IRAs. Roth IRAs. 401(k)s. Term and Whole Life. Term and Whole Life Insurance Policies. Term and Whole Life Insurance Policies 2. Term Life Insurance and Death Probability. Hedge Funds Intro. Hedge Fund Structure and Fees. Are Hedge Funds Bad?. Hedge Funds, Venture Capital, and Private Equity. Hedge Fund Strategies - Long Short 1. Hedge Fund Strategies - Long Short 2. Hedge Fund Strategies - Merger Arbitrage 1.

Open-Ended Mutual Fund (Part 1). Open-End Mutual Fund Redemptions. Closed-End Mutual Funds. Exchange Traded Funds (ETFs). Open-Ended Mutual Funds. Ponzi Schemes. Traditional IRAs. Roth IRAs. 401(k)s. Term and Whole Life. Term and Whole Life Insurance Policies. Term and Whole Life Insurance Policies 2. Term Life Insurance and Death Probability. Hedge Funds Intro. Hedge Fund Structure and Fees. Are Hedge Funds Bad?. Hedge Funds, Venture Capital, and Private Equity. Hedge Fund Strategies - Long Short 1. Hedge Fund Strategies - Long Short 2. Hedge Fund Strategies - Merger Arbitrage 1. Open-Ended Mutual Fund (Part 1). Open-End Mutual Fund Redemptions. Closed-End Mutual Funds. Exchange Traded Funds (ETFs). Open-Ended Mutual Funds. Ponzi Schemes. Traditional IRAs. Roth IRAs. 401(k)s. Term and Whole Life. Term and Whole Life Insurance Policies. Term and Whole Life Insurance Policies 2. Term Life Insurance and Death Probability. Hedge Funds Intro. Hedge Fund Structure and Fees. Are Hedge Funds Bad?. Hedge Funds, Venture Capital, and Private Equity. Hedge Fund Strategies - Long Short 1. Hedge Fund Strategies - Long Short 2. Hedge Fund Strategies - Merger Arbitrage 1.

Banking 1. Banking 2: A bank's income statement. Banking 3: Fractional Reserve Banking. Banking 4: Multiplier effect and the money supply. Banking 5: Introduction to Bank Notes. Banking 6: Bank Notes and Checks. Banking 7: Giving out loans without giving out gold. Banking 8: Reserve Ratios. Banking 9: More on Reserve Ratios (Bad sound). Banking 10: Introduction to leverage (bad sound). Banking 11: A reserve bank. Banking 12: Treasuries (government debt). Banking 13: Open Market Operations. Banking 14: Fed Funds Rate. Banking 15: More on the Fed Funds Rate. Banking 16: Why target rates vs. money supply. Banking 17: What happened to the gold?. Banking 18: Big Picture Discussion. The Discount Rate. Repurchase Agreements (Repo transactions). Federal Reserve Balance Sheet. Fractional Reserve Banking Commentary 1. FRB Commentary 2: Deposit Insurance. FRB Commentary 3: Big Picture. LIBOR. Fed Open Market Operations. Quantitative Easing. More on Quantitative Easing (and Credit Easing). Open market operations and Quantitative Easing Overview. Another Quantitative Easing Video. US and Japanese Quantitative Easing. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. CNN: Understanding the Crisis. Geithner Plan I. Geithner Plan II. Geithner Plan 2.5. Geithner Plan III. Geithner Plan IV. Geithner 5: A better solution. Currency Exchange Introduction. Currency Effect on Trade. Currency Effect on Trade Review. Pegging the Yuan. Chinese Central Bank Buying Treasuries. American-Chinese Debt Loop. Debt Loops Rationale and Effects. China keeps peg but diversifies holdings. Carry Trade Basics. Floating Exchange Resolving Trade Imbalance. China Pegs to Dollar to Keep Trade Imbalance. China buys US Bonds. Review of China US currency situation. Data on Chinese M1 Increase in 2010. Data on Chinese Foreign Assets Increase in 2010. Data on Chinese US Balance of Payments. Chinese inflation. Floating Exchange Effect on China. Floating Exchange Effect on US. Greek Debt Recession and Austerity (part 1). Greek Financial Crisis (part 2). How and why Greece would leave the Euro (part 3). Why Europe is worried about Greece. Bitcoin: What is it?. Bitcoin: Overview. Bitcoin: Cryptographic hash functions. Bitcoin: Digital signatures. Bitcoin: Transaction records. Bitcoin: Proof of work. Bitcoin: Transaction block chains. Bitcoin: The money supply. Bitcoin - The security of transaction block chains. Banking 1. Banking 2: A bank's income statement. Banking 3: Fractional Reserve Banking. Banking 4: Multiplier effect and the money supply. Banking 5: Introduction to Bank Notes. Banking 6: Bank Notes and Checks. Banking 7: Giving out loans without giving out gold. Banking 8: Reserve Ratios. Banking 9: More on Reserve Ratios (Bad sound). Banking 10: Introduction to leverage (bad sound). Banking 11: A reserve bank. Banking 12: Treasuries (government debt). Banking 13: Open Market Operations. Banking 14: Fed Funds Rate. Banking 15: More on the Fed Funds Rate. Banking 16: Why target rates vs. money supply. Banking 17: What happened to the gold?. Banking 18: Big Picture Discussion. The Discount Rate. Repurchase Agreements (Repo transactions). Federal Reserve Balance Sheet. Fractional Reserve Banking Commentary 1. FRB Commentary 2: Deposit Insurance. FRB Commentary 3: Big Picture. LIBOR. Fed Open Market Operations. Quantitative Easing. More on Quantitative Easing (and Credit Easing). Open market operations and Quantitative Easing Overview. Another Quantitative Easing Video. US and Japanese Quantitative Easing. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. CNN: Understanding the Crisis. Geithner Plan I. Geithner Plan II. Geithner Plan 2.5. Geithner Plan III. Geithner Plan IV. Geithner 5: A better solution. Currency Exchange Introduction. Currency Effect on Trade. Currency Effect on Trade Review. Pegging the Yuan. Chinese Central Bank Buying Treasuries. American-Chinese Debt Loop. Debt Loops Rationale and Effects. China keeps peg but diversifies holdings. Carry Trade Basics. Floating Exchange Resolving Trade Imbalance. China Pegs to Dollar to Keep Trade Imbalance. China buys US Bonds. Review of China US currency situation. Data on Chinese M1 Increase in 2010. Data on Chinese Foreign Assets Increase in 2010. Data on Chinese US Balance of Payments. Chinese inflation. Floating Exchange Effect on China. Floating Exchange Effect on US. Greek Debt Recession and Austerity (part 1). Greek Financial Crisis (part 2). How and why Greece would leave the Euro (part 3). Why Europe is worried about Greece. Bitcoin: What is it?. Bitcoin: Overview. Bitcoin: Cryptographic hash functions. Bitcoin: Digital signatures. Bitcoin: Transaction records. Bitcoin: Proof of work. Bitcoin: Transaction block chains. Bitcoin: The money supply. Bitcoin - The security of transaction block chains.

Banking 1. Banking 2: A bank's income statement. Banking 3: Fractional Reserve Banking. Banking 4: Multiplier effect and the money supply. Banking 5: Introduction to Bank Notes. Banking 6: Bank Notes and Checks. Banking 7: Giving out loans without giving out gold. Banking 8: Reserve Ratios. Banking 9: More on Reserve Ratios (Bad sound). Banking 10: Introduction to leverage (bad sound). Banking 11: A reserve bank. Banking 12: Treasuries (government debt). Banking 13: Open Market Operations. Banking 14: Fed Funds Rate. Banking 15: More on the Fed Funds Rate. Banking 16: Why target rates vs. money supply. Banking 17: What happened to the gold?. Banking 18: Big Picture Discussion. The Discount Rate. Repurchase Agreements (Repo transactions). Federal Reserve Balance Sheet. Fractional Reserve Banking Commentary 1. FRB Commentary 2: Deposit Insurance. FRB Commentary 3: Big Picture. LIBOR. Fed Open Market Operations. Quantitative Easing. More on Quantitative Easing (and Credit Easing). Open market operations and Quantitative Easing Overview. Another Quantitative Easing Video. US and Japanese Quantitative Easing. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. CNN: Understanding the Crisis. Geithner Plan I. Geithner Plan II. Geithner Plan 2.5. Geithner Plan III. Geithner Plan IV. Geithner 5: A better solution. Currency Exchange Introduction. Currency Effect on Trade. Currency Effect on Trade Review. Pegging the Yuan. Chinese Central Bank Buying Treasuries. American-Chinese Debt Loop. Debt Loops Rationale and Effects. China keeps peg but diversifies holdings. Carry Trade Basics. Floating Exchange Resolving Trade Imbalance. China Pegs to Dollar to Keep Trade Imbalance. China buys US Bonds. Review of China US currency situation. Data on Chinese M1 Increase in 2010. Data on Chinese Foreign Assets Increase in 2010. Data on Chinese US Balance of Payments. Chinese inflation. Floating Exchange Effect on China. Floating Exchange Effect on US. Greek Debt Recession and Austerity (part 1). Greek Financial Crisis (part 2). How and why Greece would leave the Euro (part 3). Why Europe is worried about Greece. Bitcoin: What is it?. Bitcoin: Overview. Bitcoin: Cryptographic hash functions. Bitcoin: Digital signatures. Bitcoin: Transaction records. Bitcoin: Proof of work. Bitcoin: Transaction block chains. Bitcoin: The money supply. Bitcoin - The security of transaction block chains. Banking 1. Banking 2: A bank's income statement. Banking 3: Fractional Reserve Banking. Banking 4: Multiplier effect and the money supply. Banking 5: Introduction to Bank Notes. Banking 6: Bank Notes and Checks. Banking 7: Giving out loans without giving out gold. Banking 8: Reserve Ratios. Banking 9: More on Reserve Ratios (Bad sound). Banking 10: Introduction to leverage (bad sound). Banking 11: A reserve bank. Banking 12: Treasuries (government debt). Banking 13: Open Market Operations. Banking 14: Fed Funds Rate. Banking 15: More on the Fed Funds Rate. Banking 16: Why target rates vs. money supply. Banking 17: What happened to the gold?. Banking 18: Big Picture Discussion. The Discount Rate. Repurchase Agreements (Repo transactions). Federal Reserve Balance Sheet. Fractional Reserve Banking Commentary 1. FRB Commentary 2: Deposit Insurance. FRB Commentary 3: Big Picture. LIBOR. Fed Open Market Operations. Quantitative Easing. More on Quantitative Easing (and Credit Easing). Open market operations and Quantitative Easing Overview. Another Quantitative Easing Video. US and Japanese Quantitative Easing. Bailout 1: Liquidity vs. Solvency. Bailout 2: Book Value. Bailout 3: Book value vs. market value. Bailout 4: Mark-to-model vs. mark-to-market. Bailout 5: Paying off the debt. Bailout 6: Getting an equity infusion. Bailout 7: Bank goes into bankruptcy. Bailout 8: Systemic Risk. Bailout 9: Paulson's Plan. Bailout 10: Moral Hazard. Bailout 11: Why these CDOs could be worth nothing. Bailout 12: Lone Star Transaction. Bailout 13: Does the bailout have a chance of working?. Bailout 14: Possible Solution. Bailout 15: More on the solution. CNN: Understanding the Crisis. Geithner Plan I. Geithner Plan II. Geithner Plan 2.5. Geithner Plan III. Geithner Plan IV. Geithner 5: A better solution. Currency Exchange Introduction. Currency Effect on Trade. Currency Effect on Trade Review. Pegging the Yuan. Chinese Central Bank Buying Treasuries. American-Chinese Debt Loop. Debt Loops Rationale and Effects. China keeps peg but diversifies holdings. Carry Trade Basics. Floating Exchange Resolving Trade Imbalance. China Pegs to Dollar to Keep Trade Imbalance. China buys US Bonds. Review of China US currency situation. Data on Chinese M1 Increase in 2010. Data on Chinese Foreign Assets Increase in 2010. Data on Chinese US Balance of Payments. Chinese inflation. Floating Exchange Effect on China. Floating Exchange Effect on US. Greek Debt Recession and Austerity (part 1). Greek Financial Crisis (part 2). How and why Greece would leave the Euro (part 3). Why Europe is worried about Greece. Bitcoin: What is it?. Bitcoin: Overview. Bitcoin: Cryptographic hash functions. Bitcoin: Digital signatures. Bitcoin: Transaction records. Bitcoin: Proof of work. Bitcoin: Transaction block chains. Bitcoin: The money supply. Bitcoin - The security of transaction block chains.

American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility. American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility.

American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility. American Call Options. Basic Shorting. American Put Options. Call Option as Leverage. Put vs. Short and Leverage. Call Payoff Diagram. Put Payoff Diagram. Put as Insurance. Put-Call Parity. Long Straddle. Put Writer Payoff Diagrams. Call Writer Payoff Diagram. Arbitrage Basics. Put-Call Parity Arbitrage I. Put-Call Parity Arbitrage II. Put-Call Parity Clarification. Actual Option Quotes. Option Expiration and Price. Forward Contract Introduction. Futures Introduction. Motivation for the Futures Exchange. Futures Margin Mechanics. Verifying Hedge with Futures Margin Mechanics. Futures and Forward Curves. Contango from Trader Perspective. Severe Contango Generally Bearish. Backwardation Bullish or Bearish. Futures Curves II. Contango. Backwardation. Contango and Backwardation Review. Upper Bound on Forward Settlement Price. Lower Bound on Forward Settlement Price. Arbitraging Futures Contract. Arbitraging Futures Contracts II. Futures Fair Value in the Pre-Market. Interpreting Futures Fair Value in the PreMarket. Mortgage Back Security Overview. Mortgage-Backed Securities I. Mortgage-backed securities II. Mortgage-backed securities III. Collateralized Debt Obligation Overview. Collateralized Debt Obligation (CDO). Credit Default Swaps (CDS) Intro. Credit Default Swaps. Credit Default Swaps 2. Use Cases for Credit Default Swaps. Financial Weapons of Mass Destruction. Interest Rate Swap 1. Interest Rate Swap 2. Introduction to the Black Scholes Formula. Implied volatility.

What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring.

What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. What it means to buy a company's stock. Bonds vs. Stocks. Basic Shorting. Shorting Stock. Shorting Stock 2. Is short selling bad?. Gross and Operating Profit. Basic Capital Structure Differences. Market Capitalization. Market Value of Assets. Price and Market Capitalization. Introduction to the Income Statement. Earnings and EPS. Introduction to the Price-to-Earnings Ratio. P/E Discussion. ROA Discussion 1. ROA Discussion 2. Depreciation. Amortization. P/E Conundrum. Enterprise Value. EBITDA. Raising money for a startup. Getting a seed round from a VC. Going back to the till: Series B. An IPO. More on IPOs. Equity vs. Debt. Bonds vs. Stocks. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring. Stock Dilution. Acquisitions with Shares. Price Behavior After Announced Acquisition. Simple Merger Arb with Share Acquisition. Basic Leveraged Buyout (LBO). Corporate Debt versus Traditional Mortgages. Introduction to Bonds. Introduction to the yield curve. Relationship between bond prices and interest rates. Treasury Bond Prices and Yields. Annual Interest Varying with Debt Maturity. The Yield Curve. Chapter 7:Bankruptcy Liquidation. Chapter 11: Bankruptcy Restructuring.

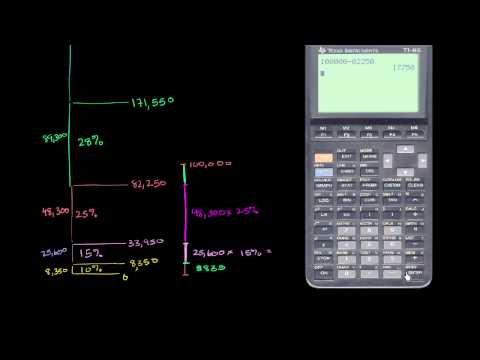

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens.

Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens. Basics of US Income Tax Rate Schedule. Tax Deductions Introduction. AMT Overview. Alternative Minimum Tax. Estate Tax Introduction. Estate Tax Basics. Tax brackets and progressive taxation. Calculating federal taxes and take home pay. Calculating state taxes and take home pay. Marriage penalty. Married taxes clarification. Corporations and Limited Liability. Is Limited Liability or Double Taxation Fair. Transfer Pricing and Tax Havens.

By Shahid Ansari and Jan Bell

What you do not know about money can really affect your entire life! Financial Literacy is a free, online introductory course about personal financial management. In this interactive multimedia course, a series of seven dynamic modules covering everything from how to set up your first bank account to planning for your retirement will put you on the path to financial fitness!

Learn how to succeed in the Forex Market by using simple trend following techniques.

An Overview Of The Forex Market To Help You Determine If Getting Involved Is For You. / Get Your Feet Wet For Free.

learn about the basics of forex trading and how to use the Meta Trader 4 platform

For aspiring traders to quickly pick up the basics of FX, FX trading and Price Action Trading Methodology.

This course teaches trading tactics in the forex market using live events to determine price direction. It combines both

Trusted paper writing service WriteMyPaper.Today will write the papers of any difficulty.